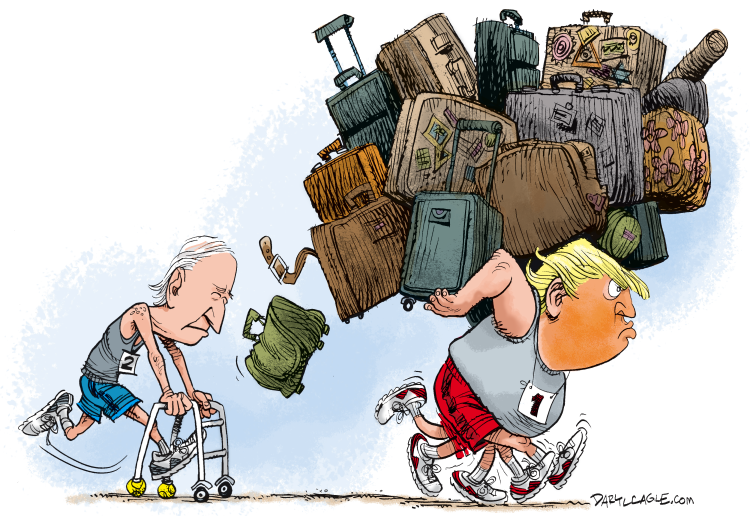

The new Republican tax plan takes away the deduction for state income taxes, which will hit the high-tax blue states hardest. The red states that voted for Trump are the federal welfare cases.

This cartoon features very blue California and very red Tennessee, two great examples of blue-donor and red-dependent states. I drew this one as a local cartoon for the weekly Nashville Scene when I was living in Nashville and I updated it a bit to apply to the issue today. Things don’t change much.

If this was an issue of fairness, the income tax should be reduced in hight-tax donor states and increased in low-tax dependent states. Of-course this is not an issue of fairness. The red states voted for Trump and now it is time for them to get some payback, at the expense of the Hillary states.